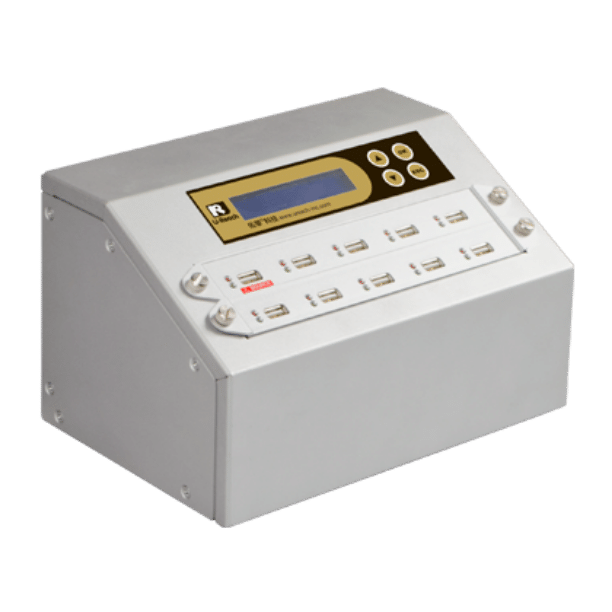

Data Duplicator for Banking & Insurance – Why Choose U-Reach

Banks and insurance companies rely on secure, consistent, and high-integrity data deployment to support branch operations, digital services, customer systems, and regulatory platforms. U-Reach duplicators deliver the reliability, security, and compliance required in highly regulated financial environments where accuracy and protection are essential.

Secure, Standalone Hardware (No OS, No Internal Storage, No Cyber Risk)

U-Reach duplicators operate on FPGA-controlled hardware without an operating system or internal hard drive.

For financial institutions, this provides:

Zero exposure to malware, ransomware, or OS exploits

No risk of customer data or system logs being stored on the unit

Safe operation inside secured data centers, branch IT rooms, and sensitive environments

This architecture meets the strict cybersecurity standards required by modern financial operations.

Fast, Consistent Duplication for Large Financial Deployments

Banks and insurers frequently roll out or refresh large numbers of devices, including workstations, POS terminals, ATMs, kiosks, servers, and tablet-based systems. U-Reach supports:

Multi-port parallel duplication

Stable, full-speed performance even during bulk imaging

Perfectly identical system images across every device

This ensures faster rollout of digital banking platforms, customer service terminals, and backend systems.

Supports All Media Used in Financial IT Infrastructure

U-Reach duplicators handle the full range of storage media used across financial environments, including:

NVMe & M.2 SSD

SATA SSD/HDD

USB drives used for secure deployment kits

SD/CF for banking equipment and embedded devices

This makes U-Reach a universal platform for IT imaging across all branches, departments, and data centers.

Traceable Logs for Compliance & Internal Governance

Financial institutions must maintain strong documentation for internal audits and regulatory compliance.

U-Reach provides tamper-proof duplication logs including:

Serial numbers

Pass/fail verification

Timestamp

Operating method and setup

These records support compliance with IT governance, ISO standards, and internal audit requirements.

Built for Long-Term, Enterprise-Grade Reliability

U-Reach duplicators are engineered for continuous use, ensuring stable performance for multi-year enterprise deployment cycles.

UReach Duplicator for

Data Eraser for Banking & Insurance – Why Choose U-Reach

Banks and insurance companies manage extremely sensitive information, including customer financial records, identity data, transaction logs, underwriting documents, and proprietary algorithms. Any drive used in production, testing, or branch operations must be securely wiped before reuse or disposal. U-Reach data erasers provide a secure, compliant, and verifiable erasure process built specifically for highly regulated industries.

Standalone, Secure Operation with No Risk of Data Retention

U-Reach erasers operate on FPGA-based hardware with no OS and no internal storage.

This ensures:

No hidden logs or data traces remain in the equipment

No OS vulnerabilities, malware risks, or cybersecurity concerns

Safe operation in restricted and confidential environments

Perfect for bank vault IT rooms, data centers, and compliance-controlled zones.

Fast, Multi-Port Erasure for High-Volume Environments

Banks and insurers routinely process drives from retired systems, branch equipment, ATM machines, POS devices, and employee laptops. U-Reach supports:

Parallel erasure across multiple drives

High-speed, stable performance

Efficient workflows for IT asset management and refresh projects

This dramatically reduces time and manpower needed for large-scale data sanitation.

Certified Erasure Standards for Regulatory Compliance

U-Reach supports globally recognized secure erasure methods, including:

NIST 800-88 Purge/Clear

DoD 5220.22-M

Secure Erase / Sanitize

These standards help financial institutions comply with:

GLBA (Gramm-Leach-Bliley Act)

PCI-DSS

ISO 27001

Local data protection regulations

Ensuring sensitive customer and financial data is permanently removed.

Supports All Storage Media Used in Financial Systems

U-Reach erasers can securely wipe the broad range of storage devices used in banks and insurance operations:

NVMe & SATA SSD

USB flash drives

SD/microSD used in terminals and kiosks

SATA/SAS HDD used in servers and backup systems

This allows IT teams to sanitize all media using a single, unified solution.

Tamper-Proof Erasure Reports for Audit & Compliance

Documentation is essential for financial governance. U-Reach generates detailed erasure reports containing:

Serial numbers

Erasure method used

Pass/fail status

Timestamp and port details

These logs support internal audits, compliance documentation, SOC reporting, and IT asset lifecycle management.

Ideal for Enterprise IT, Data Centers & Branch Operations

U-Reach erasers are built for continuous, enterprise-level use, making them perfect for:

Banking data centers

Branch IT refresh projects

Insurance underwriting offices

Secure equipment retirement programs

Managed IT service providers (MSPs) supporting financial clients

UReach Eraser for

Data Duplicator

Data Duplicator for Banking & Insurance – Why Choose U-Reach

Banks and insurance companies rely on secure, consistent, and high-integrity data deployment to support branch operations, digital services, customer systems, and regulatory platforms. U-Reach duplicators deliver the reliability, security, and compliance required in highly regulated financial environments where accuracy and protection are essential.

Secure, Standalone Hardware (No OS, No Internal Storage, No Cyber Risk)

U-Reach duplicators operate on FPGA-controlled hardware without an operating system or internal hard drive.

For financial institutions, this provides:

Zero exposure to malware, ransomware, or OS exploits

No risk of customer data or system logs being stored on the unit

Safe operation inside secured data centers, branch IT rooms, and sensitive environments

This architecture meets the strict cybersecurity standards required by modern financial operations.

Fast, Consistent Duplication for Large Financial Deployments

Banks and insurers frequently roll out or refresh large numbers of devices, including workstations, POS terminals, ATMs, kiosks, servers, and tablet-based systems. U-Reach supports:

Multi-port parallel duplication

Stable, full-speed performance even during bulk imaging

Perfectly identical system images across every device

This ensures faster rollout of digital banking platforms, customer service terminals, and backend systems.

Supports All Media Used in Financial IT Infrastructure

U-Reach duplicators handle the full range of storage media used across financial environments, including:

NVMe & M.2 SSD

SATA SSD/HDD

USB drives used for secure deployment kits

SD/CF for banking equipment and embedded devices

This makes U-Reach a universal platform for IT imaging across all branches, departments, and data centers.

Traceable Logs for Compliance & Internal Governance

Financial institutions must maintain strong documentation for internal audits and regulatory compliance.

U-Reach provides tamper-proof duplication logs including:

Serial numbers

Pass/fail verification

Timestamp

Operating method and setup

These records support compliance with IT governance, ISO standards, and internal audit requirements.

Built for Long-Term, Enterprise-Grade Reliability

U-Reach duplicators are engineered for continuous use, ensuring stable performance for multi-year enterprise deployment cycles.

UReach Duplicator for

Data Eraser

Data Eraser for Banking & Insurance – Why Choose U-Reach

Banks and insurance companies manage extremely sensitive information, including customer financial records, identity data, transaction logs, underwriting documents, and proprietary algorithms. Any drive used in production, testing, or branch operations must be securely wiped before reuse or disposal. U-Reach data erasers provide a secure, compliant, and verifiable erasure process built specifically for highly regulated industries.

Standalone, Secure Operation with No Risk of Data Retention

U-Reach erasers operate on FPGA-based hardware with no OS and no internal storage.

This ensures:

No hidden logs or data traces remain in the equipment

No OS vulnerabilities, malware risks, or cybersecurity concerns

Safe operation in restricted and confidential environments

Perfect for bank vault IT rooms, data centers, and compliance-controlled zones.

Fast, Multi-Port Erasure for High-Volume Environments

Banks and insurers routinely process drives from retired systems, branch equipment, ATM machines, POS devices, and employee laptops. U-Reach supports:

Parallel erasure across multiple drives

High-speed, stable performance

Efficient workflows for IT asset management and refresh projects

This dramatically reduces time and manpower needed for large-scale data sanitation.

Certified Erasure Standards for Regulatory Compliance

U-Reach supports globally recognized secure erasure methods, including:

NIST 800-88 Purge/Clear

DoD 5220.22-M

Secure Erase / Sanitize

These standards help financial institutions comply with:

GLBA (Gramm-Leach-Bliley Act)

PCI-DSS

ISO 27001

Local data protection regulations

Ensuring sensitive customer and financial data is permanently removed.

Supports All Storage Media Used in Financial Systems

U-Reach erasers can securely wipe the broad range of storage devices used in banks and insurance operations:

NVMe & SATA SSD

USB flash drives

SD/microSD used in terminals and kiosks

SATA/SAS HDD used in servers and backup systems

This allows IT teams to sanitize all media using a single, unified solution.

Tamper-Proof Erasure Reports for Audit & Compliance

Documentation is essential for financial governance. U-Reach generates detailed erasure reports containing:

Serial numbers

Erasure method used

Pass/fail status

Timestamp and port details

These logs support internal audits, compliance documentation, SOC reporting, and IT asset lifecycle management.

Ideal for Enterprise IT, Data Centers & Branch Operations

U-Reach erasers are built for continuous, enterprise-level use, making them perfect for:

Banking data centers

Branch IT refresh projects

Insurance underwriting offices

Secure equipment retirement programs

Managed IT service providers (MSPs) supporting financial clients